What is EPS (Earnings Per Share) – Complete Guide with Examples

What is EPS (Earnings Per Share)?

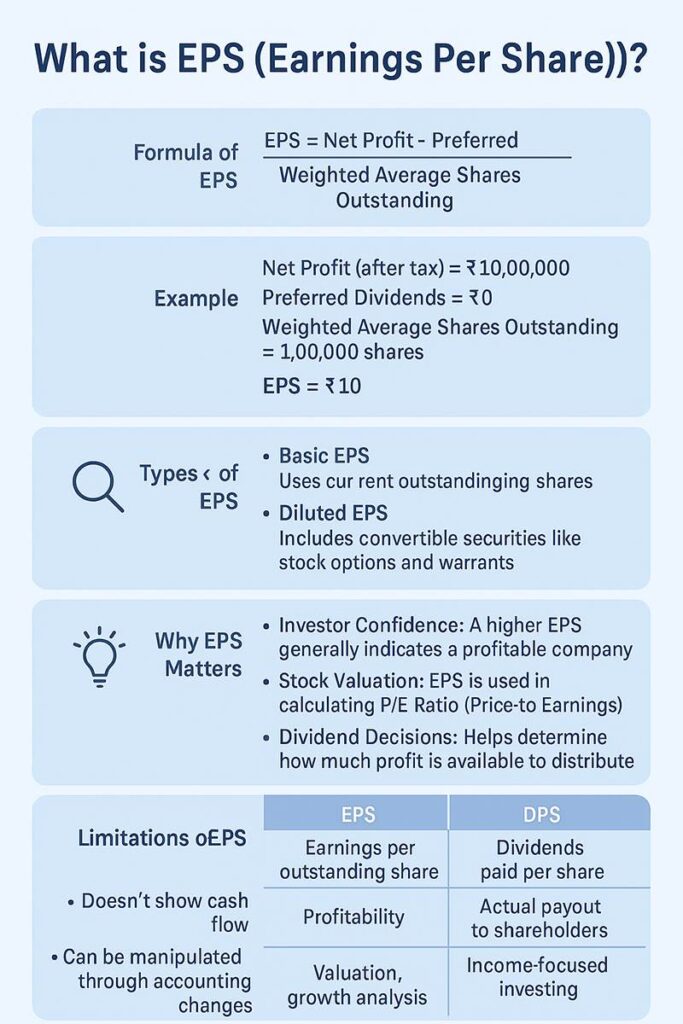

Earnings Per Share (EPS) is one of the most important financial metrics used by investors to assess a company’s profitability. It tells you how much profit a company has generated for each outstanding share of its stock.

Formula of EPS:

EPS=Net Profit−Preferred DividendsWeighted Average Shares Outstanding\text{EPS} = \frac{\text{Net Profit} – \text{Preferred Dividends}}{\text{Weighted Average Shares Outstanding}}EPS=Weighted Average Shares OutstandingNet Profit−Preferred Dividends

Example:

Let’s say:

- Net Profit (after tax) = ₹10,00,000

- Preferred Dividends = ₹0

- Weighted Average Shares Outstanding = 1,00,000 shares

EPS=10,00,000−01,00,000=₹10\text{EPS} = \frac{10,00,000 – 0}{1,00,000} = ₹10EPS=1,00,00010,00,000−0=₹10

This means the company generated ₹10 profit per share.

Types of EPS:

- Basic EPS: Uses the current outstanding shares.

- Diluted EPS: Includes convertible securities like stock options and warrants, giving a more conservative view.

Why EPS Matters?

- Investor Confidence: A higher EPS generally indicates a profitable company.

- Stock Valuation: EPS is used in calculating P/E Ratio (Price-to-Earnings), another key valuation metric.

- Dividend Decisions: Helps determine how much profit is available to distribute.

EPS vs. Dividend per Share (DPS)

| Metric | EPS | DPS |

|---|---|---|

| Definition | Earnings per outstanding share | Dividends paid per share |

| Indicates | Profitability | Actual payout to shareholders |

| Used for | Valuation, growth analysis | Income-focused investing |

Limitations of EPS

- Doesn’t show cash flow

- Can be manipulated through accounting changes

- Doesn’t reflect debt or capital structure

Final Thoughts

EPS is a fundamental metric to evaluate a company’s earning strength on a per-share basis. However, it should not be used in isolation. Combine EPS analysis with revenue trends, margins, debt levels, and industry benchmarks for a complete picture.