Understanding Market Structure: From IPOs to Clearing & Settlement

Introduction:

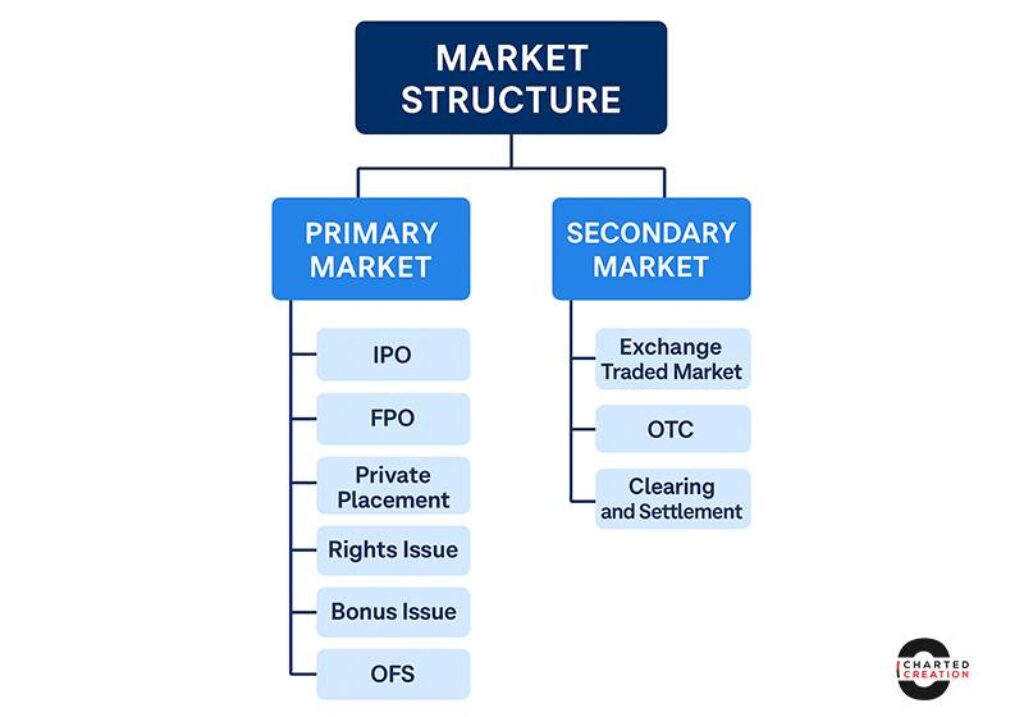

Understanding the market structure is the first step for anyone interested in investing or trading. The market is broadly classified into two major segments: the Primary Market and the Secondary Market. Each plays a unique role in the financial ecosystem by connecting businesses and investors.

Primary Market

The Primary Market is where securities are created and sold to investors for the first time. Companies raise capital directly from the public or institutional investors.

Key Components:

- Initial Public Offering (IPO) – A company offers its shares to the public for the first time to raise capital.

- Follow-on Public Offering (FPO) – An already listed company issues new shares to raise additional funds.

- Private Placement – Securities are sold to a small group of institutional or private investors rather than the public.

- Rights Issue – Existing shareholders are given the right to purchase more shares at a discounted price.

- Bonus Issue – Free additional shares are given to existing shareholders in proportion to their current holdings.

- Offer for Sale (OFS) – Promoters sell their shares directly on the stock exchange to meet minimum public shareholding requirements.

Secondary Market

Once securities are issued in the primary market, they get listed and can be traded in the Secondary Market.

Two Main Types:

Exchange-Traded Market – Stocks are traded on regulated exchanges like NSE and BSE under strict guidelines.

Over-The-Counter (OTC) Market – Trading takes place directly between two parties without using an exchange.

Clearing and Settlement

Once a trade is executed:

- It is cleared (obligations are determined),

- Then settled (shares and funds are exchanged).

In India, most trades are settled on a T+1 basis (Trade day + 1 working day), and NSDL/CDSL are the depositories that hold your shares in demat form.

Conclusion:

The market structure forms the backbone of capital markets. As an investor, knowing the difference between Primary and Secondary Markets, and how clearing and settlement work, gives you an edge and builds confidence in the process.