Potential in Stock Market – Real Examples & Success Stories to Inspire You

The potential in stock market investing is immense, and countless people around the world have used it as a tool to build long-term wealth, gain financial independence, and even become billionaires. While the market carries risks, smart investing backed by research, discipline, and patience can yield life-changing returns.

Let’s explore the true potential in stock market investments with real examples and five globally respected success stories.

Understanding the Potential in Stock Market

Investing in the stock market allows individuals to become part-owners of companies. When you buy a stock, you’re buying a small share in a business, and if that business grows, your wealth grows too.

Real Example:

- Apple Inc. (AAPL):

If you had invested $1,000 in Apple in the year 2000, your investment would be worth over $100,000+ today. That’s the power of compounding and long-term investing.

- Apple Inc. (AAPL):

5 Successful Stock Market Investors Who Tapped the Potential

1. Warren Buffett (USA)

Net Worth: ~$130 Billion

Known For: Value investing, long-term compound growth

Famous Quote: “The stock market is a device for transferring money from the impatient to the patient.”

Buffett’s investments in companies like Coca-Cola, Apple, and American Express helped him grow Berkshire Hathaway into a giant.

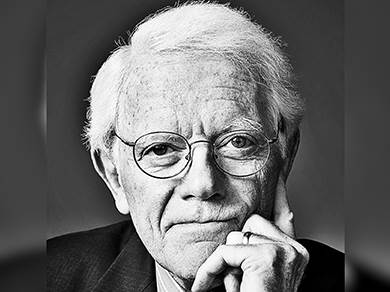

2. Peter Lynch (USA)

Net Worth: ~$450 Million

Known For: Managing Fidelity Magellan Fund with 29% annual returns

Strategy: “Invest in what you know”

Lynch believed ordinary investors could beat the pros by focusing on everyday products and services they understand.

3. Radhakishan Damani (India)

Net Worth: ~$20 Billion

Known For: Early investor in Titan, VST Industries, and founder of DMart

Damani started as a quiet value investor and later built one of India’s most successful retail chains. His story shows how disciplined investing can fund entrepreneurial dreams.

4. George Soros (Hungary/USA)

Net Worth: ~$7 Billion

Known For: High-risk global macro trades

In 1992, Soros famously “broke the Bank of England” by shorting the British pound and made $1 billion in a day.

5. Rakesh Jhunjhunwala (India, late)

Net Worth (at peak): ~$6 Billion

Known As: “The Big Bull of India”

He turned ₹5,000 into billions by spotting multi-bagger stocks like Titan early. His investing philosophy was a mix of value and optimism about India’s growth story.

What Can We Learn from These Investors?

| Lesson | Description |

|---|---|

| Long-Term Thinking | All successful investors hold stocks for years, not days. |

| Value Over Hype | They focus on solid business models, not market fads. |

| Risk Management | They understand when to invest big and when to cut losses. |

| Patience Pays Off | Real wealth comes from waiting through market cycles. |

| Knowledge is Power | Deep research is a common trait among them. |

Is Stock Market a Good Opportunity for You?

Absolutely. Whether you’re a student, working professional, or retiree — the potential in stock market is accessible to anyone with the right mindset and strategy. With online platforms and fractional investing, even small amounts can start your journey.

Caution:

- Always research before investing.

- Never invest money you can’t afford to lose.

- Start with index funds or well-known stocks if you’re a beginner.

Final Thoughts

The potential in stock market is not just about getting rich overnight. It’s about wealth creation over time. The real secret lies in learning from legends, staying disciplined, and keeping emotions out of your decisions.

Let these 5 investor stories serve as proof that smart investing works — and you can start today, no matter your background or budget.